|

Date |

ArticleType |

|

3/8/2018 |

Press Release |

|

CEO Interviewed on Credit Union/Bank Tax Parity Issue |

|

|

CEO Interviewed on Credit Union/Bank Tax Parity Issue

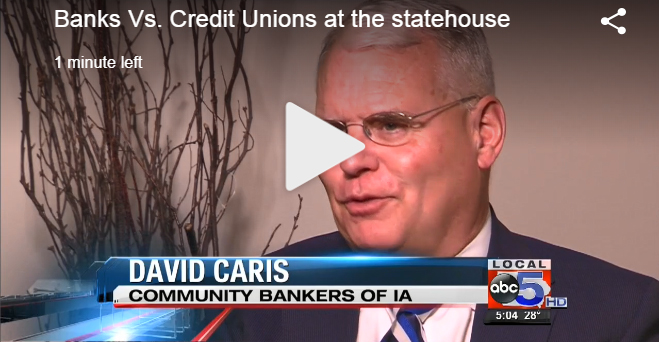

Community Bankers of Iowa CEO Dave Caris was interviewed by local ABC affiliate WOI-TV Channel 5 regarding Iowa community banks' stance on a tax reform bill introduced by Iowa Senate Republicans. Click here to view video. Community Bankers of Iowa CEO Dave Caris was interviewed by local ABC affiliate WOI-TV Channel 5 regarding Iowa community banks' stance on a tax reform bill introduced by Iowa Senate Republicans. Click here to view video.

SF 2383, a reform package containing language providing tax equity between banks and credit unions, passed the Iowa Senate on a party-line vote of 29-21 and now heads to the House. The legislation proposes to redefine "financial institutions" in Iowa, extends the existing franchise tax to credit unions and adjusts the tax rate based on net income. Banks and credit unions would pay a 2% franchise tax on net incomes below $7.5 million, and a 4% rate on net incomes over $7.5 million.

SF 2383 faces an uncertain future in the Iowa House, as House Republicans will be working from Governor Reynolds' proposed legislation and it does not include any business tax reforms. It's important that bankers speak out to policy makers on this critical issue to counter the onslaught of contacts from credit unions. Iowa Bankers Association (IBA) has developed an excellent and quick method of finding and emailing your State Legislator to speak out on this issue. Just click here.

The IBA and CBI are united on this major issue. We urge you to email your State Senator and Representative and tell them it's time to end the free ride. Click here for a list of key points you may want to consider.

|

|

|